World War One brought great but brief wealth to the cotton planters of Dixie, including Athens, Georgia.

From 1908- 16, before the USA entered The War, cotton fluctuated between 9 and 12 cents a pound, though occasionally it might spike as high as 15.

On April 6, 1917, the USA declared War.

At the end of 1916, as US War fever rose, cotton also rose to 17 cents.

One year later cotton stabilized around the previously unimaginable 30 cents per pound.

After the Armistice of Nov 11, 1918 European finance and manufacturing were a big mess. The price of cotton continued to climb.

Cotton attained a hallucinatory high of 44 cents during April 1920.

The giddy height maintained itself until October of 1920 brought an overnight crash to 25 cents. Declines continued through January to 16 cents.

From there, cotton eventually stabilized to around 20 cents, which, adjusting for inflation was about the equivalent of pre-war prices.

Though cotton and other commodity suppliers enthusiastically supported the war effort, it was the northern manufacturing industrialists who structured the war effort to be their enduring bonanza.

From the end of April until the end of September 1917, the US Congress determined how the war would be paid for.

Everyone knew that the profits of armaments manufacturers would soar to untold heights. Their profits had already risen dazzlingly between 1914-16, and that's only from foreign demand.

Now with the US government as their customer... a customer without a standing military or modern material, there was no foreseeable limit to profitably.

A small but powerful contingent of Congressmen wanted to pay for the war by taxing excess profits on the sale of war material.

Following is a general documentary of how that effort turned out, as reported by the newspapers of Athens Georgia.

It is also the story of our government's strategy for levying income tax to this day.

The articles contain amazing detail of mind-boggling logic.

If you're using a desktop device you can enlarge the articles for easy reading by narrowing the vertical width of the browser window by about 50%

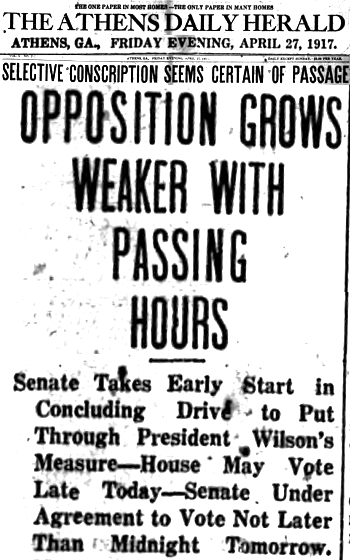

The conscription of men and the conscription of wealth are closely linked in the Congressional proceedings.

The session opens with curious declarations relating the concept of conscription to democracy.

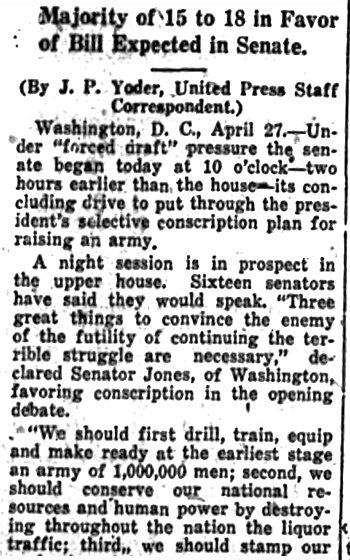

The opening salvo of incongruous logic is delivered by Senator Jones. He insists on sealing a Congressional Profession of Democracy by relating the linking together the conscription of men, alcohol prohibition, and the Women's vote.

From there, the Honorable Senator Jones performs a dizzying about face declaring there's NO GOOD REASON NOT TO FORCE MEN TO FIGHT because, as English aristocrats say, WAR IS UNDEMOCRATIC.

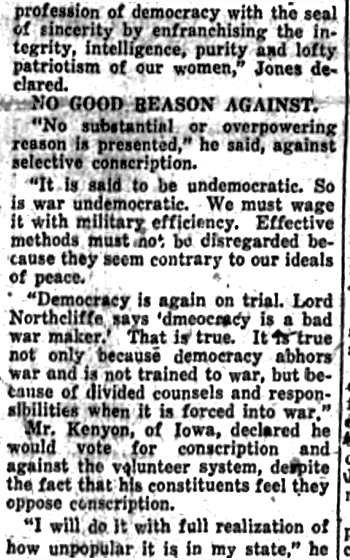

Next, Senator Kenyon (who will play a key role) explains that lawmakers should ignore the wishes of their constituents and vote for the conscription of men.

Senator Kenyon continues by declaring that any income over $100,000 should be conscripted.

We'll learn later that when he says income, he doesn't mean war profit.

Remember, that in April of 1917, the federal income tax doesn't yet exist. Different states have different definitions of taxable income (if they have any income tax at all).

Know that in Athens, Georgia of 1917, anyone making $1000 a year is a solid, middle-class bread earner. A well made, but modest house would cost $1000, a new car $300, a fine new suit $50. Lunch at a respectable diner is 25¢

Between 1908 and 1916 wages and cost of living in the USA remained fairly constant.

According to the news article we're examining, munitions and armament suppliers has increases in PROFIT that defy imagination:

United States Steel 1836%

Bethlehem Steel 669%

Dupont Powder 1950%.

Now an obscene harangue that each man must sacrifice his life as THE NATION decrees. Who exactly IS this Nation?. Just a few paragraphs ago, the senators admitted that their CONSTITUENTES DID NOT WANT WAR. Who is it that wants this war? Could it be the businessmen who hold both seats in the US Congress and shares in US Steel, DuPont Powder... ?

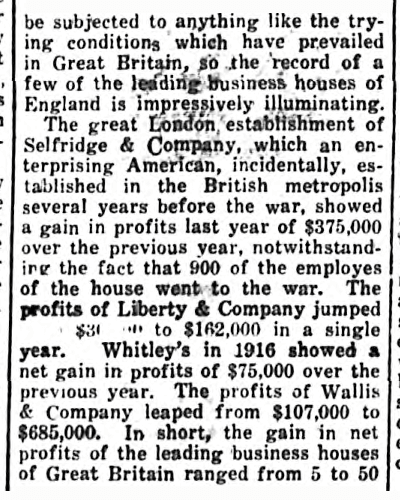

If you doubt that war is good, look how Britain's gray-haired gents are doing while their sons are blown to smithereens. True, “These are cold facts...” and their profit is only about 500% growth, but the USA has much less trying conditions.

William Gibbs McAdoo is Secretary of the US Treasury. He's a native Georgian from an extremely prestigious family. He's President Woodrow Wilson's son-in-law.

Who knows if he actually said what is quoted in the newspaper. The importance is that it reflects what people intend should happen.

McAdoo believed racial segregation to be vital to the interests of the national economy.

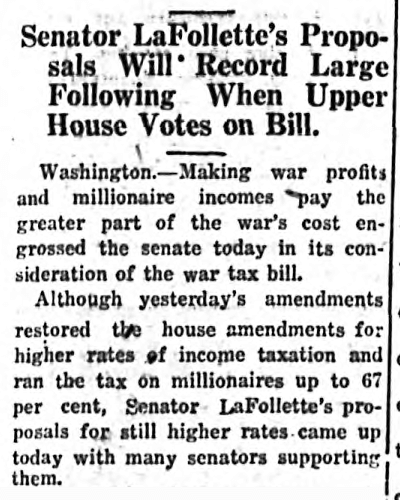

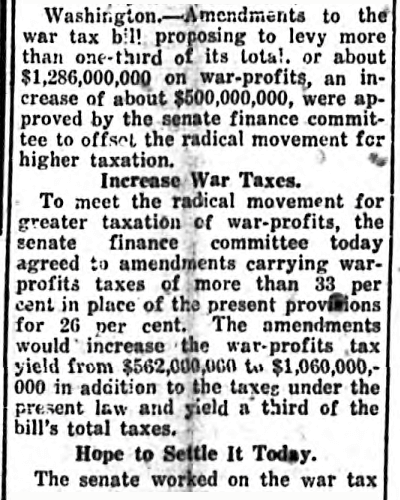

Congress has been negotiating for months on the means to pay for the war. In August, a bold contingent led by Senator Robert LaFollette (French for the little crazy one) shocks the nation by breaking ranks with the plutocrats.

Senator Simmons responds to Senator Follette by inventing a fraudulent rational (that taxing the rich is unpatriotic) and an inexplicable (but scary sounding) statistic , both of which have little to do with expecting the rich to pay for the war according to the increased wealth it brings them. Wealth they gain by the forced conscription of lives.

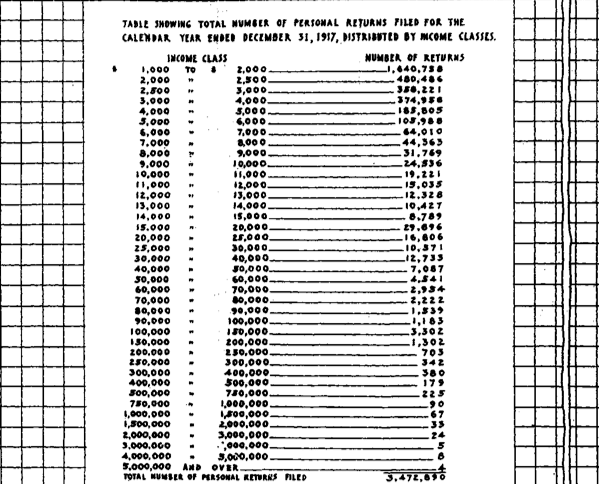

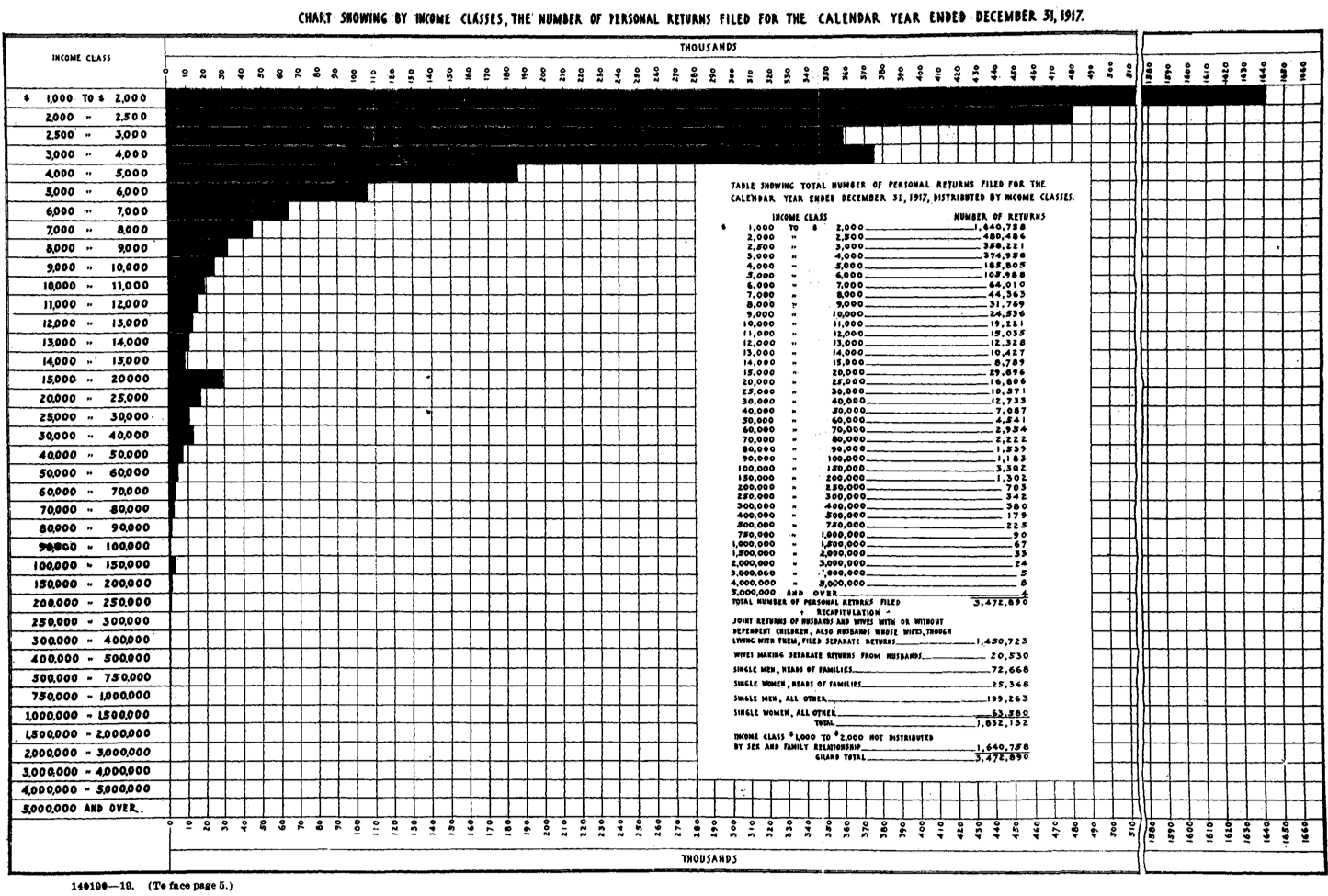

Let's be clear who has the money in 1917.

3,472,890 income tax returns were filed at the end of 1917.

47% of households (1,640,758) make between $1,000 and $2,000.

23% of households (973,027) make more than $2,000 but less than $30,000.

0.5% of households (19,452) make more than $30,000 but less than $1,000,000.

0.007% of households (225) make between $1,000,000 and $5,000,000... OR MORE.

Table from the Treasury Department UNITED STATES INTERNAL REVENUE

Statistics of Income compiled from the returns for 1917 under the direction of the commissioner of Internal Revenue.

Washington Printing Office 1919

This graphic sums up how the USA enables wealth, both then and now.

Totaling all listed classes we do not arrive at 100% of 3,472,890.

30% of the US population that filed a tax return earns less than $1,000 per year.

These statistics can only be considered a sample of the US population. This sample is likely to under-report the poverty of the USA.

1917 is the first year that federal income tax was levied. It appears that 88% of households did not file a tax return.

103,300,000 people are estimated to have lived in the USA in 1917. This includes household dependents who would not file a tax return.

The average size of a household in 1917 is 3.5 people, according to Pew Research.

103,300,000 (Total USA Population) ÷ 3.5 = 29,514,286.

But 29,514,286 tax returns were not filed in 1917. Only 3,472,890 tax returns were filed.

If we have 29,514,286 households but only 3,472,890 tax returns, this means that 88% of households did not file a tax return in 1917. Only 12% of households filed a tax return.

Normally, we would assert that 12% is an excellent statistical sample. However, in this situation prosperous households have much higher visibility to tax officials and are more likely to file returns. Tax officials have less visibility to less prosperous households. Less prosperous households are less likely to file tax returns.

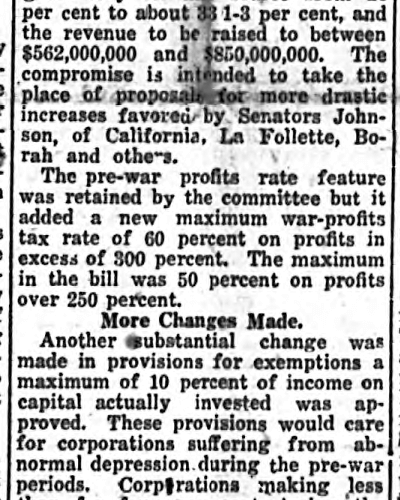

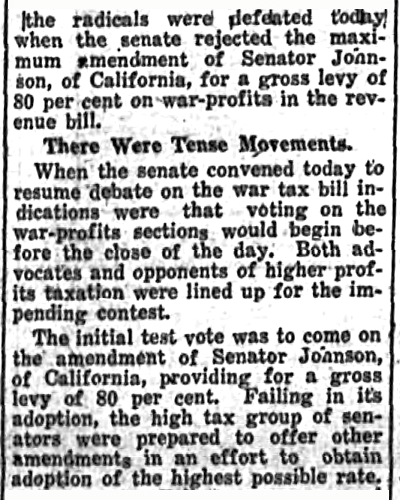

Within a few days LaFollette's group is as known as THE RADICALS, each of them showing strong leadership, especially Senator Johnson of California.

The Radicals have the rest of the Senate on the run and force extreme changes in the Senate's original proposal.

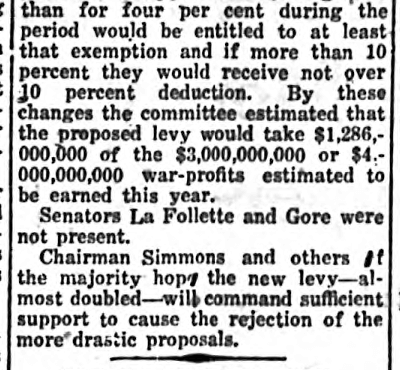

Despite the progress, the Senate cannot bear to seriously tax the estimated 3.5 BILLION dollars in PURE PROFIT that will be GENERATED IN 1917.

In 2020 money that is 775 billion dollars. More than HALF A TRILLION DOLLARS A YEAR going to a tiny minority of the entire US population as dividend paying stocks that are not taxable (the dividends are taxable but the stocks are not, as it should be). Who do you think will be receiving those dividends? The Congressmen?

Big business is booming. Ports and Railroads are working to capacity.

But with all the men gone, who'll work in the factories? Relax, child labor laws won't be passed until 1944!

And because our poorly paid service men are risking their lives. We're revamping military life insurance. Death benefits are slashed from $10,000 to $5,000.

The Radical have the Plutocrats running scared.

“OK, OK, we'll more than double the War Profit target amount, OK? But we gotta close the deal, quick, OK? Take it or leave it.”

“No thanks. We're not interested in setting fixed target amounts from your profits. Profits that will likely be much higher than you estimate. We're thinking of percentages of your profits.”

The Radicals spread out and prepare their final assault on the Plutocrats.

The Radicals make 3 proposals for different war profit tax rates.

Sen. Bankhead: 75%.

Sen. LaFollette: 76% to 48%.

Senators Holland, Gore, Brady: 50% to 66.66%.

The war is generally unpopular with the USA public. The previous year's elections won by “KEEP US OUT OF WAR!” slogans.

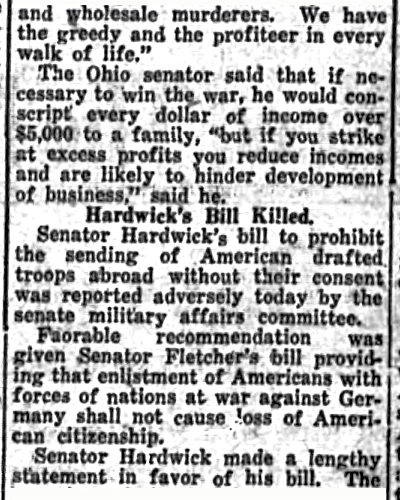

Senator Warren G. Harding leads the charge against the The Radicals.

Sen. Warren warns against “...too great a conscription of wealth. Each should pay for the war according his ability.

My colleagues, everyone should pay, as we oblige them, according to their situation.”

The WAR is very unpopular. OUR Republic is overrun with aliens. SIRS, we harbor skilled propagandists! Spreading sedition, plotting bombings and wholesale murder! We ARE... excuse me... We have WHOLESALE MURDERERS!

We HAVE the GREEDY and the PROFITEER in EVERY WALK OF LIFE. AT LAST we must tax those whom we can... tax those who CAN pay!

Warren G. Harding continues with his proposal to tax war profits.

“For those FAMILIES earning more than $5,000... I would CONSCRIPT EVERY DOLLAR OVER $5,000.

Last year we campaigned against The War. Many of US were elected last year, pledging to Keep US out of war. But if YOU strike at excess profits, YOU reduce US INCOMES. YOU are likely to hinder business development!”

Senator Harding will be elected President of The USA in 1920. One of the most popular Presidents up to his time, he presides over The Roaring Twenties.

The TeaPot Dome scandal shows Warren G. Harding as one of the MOST CORRUPT PRESIDENTS in USA history. From 1921-23, Harding had the US military give non-competitive leases to private oil companies, favoring government officials, at Teapot Dome Oil Fields, Wyoming.

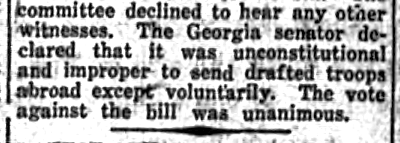

The Radicals counter by proposing Sen. Johnson's (R-CA) 80% war profits tax. It failed 17 to 62.

Sen. Johnson protests the consciences of his peers.

“We must take war profits with the same vigor and virility, with which we throw our youth toward death!”

The plutocrats respond.

“We can best know the true profit after the war is won.

USE profit to invest in the war effort. We need profit to develop and win the war. Profit motivates US war success. Patriotism. Tax war profits after the war's won.”

“You're kidding me.

England has an 80% war profit tax. Their business is fine.”

“Are you kidding US? What losers! That's why we gotta go fight for them!”

“You don't want the US to lose too? Do you? That's sedition. You know. We need all those profits otherwise we'll loose. Like Britain. You don't support the seditionists. Senator Johnson, are you TRYING TO MAKE THE WAR UNPOPULAR?”

“The War ALREADY IS UNPOPULAR. If we must conscript man-power, let us conscript money-power as well.

Democracy means more than TAKE WHAT YOU CAN GET.

We are better than ancient, pillaging European democracies.”

“We'll pay the US back after the war.”

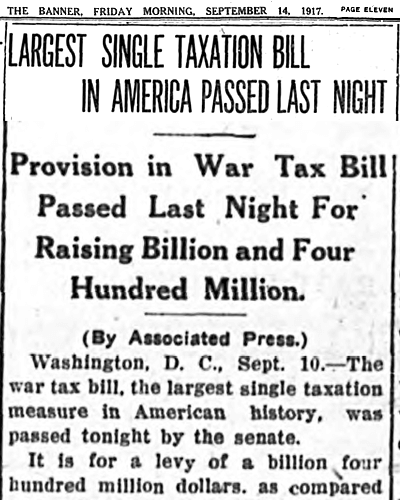

By a vote of 69 to 4, the largest US tax bill, yet known at the time, passed on Sept. 10, 1917. $1,400,000,000.

Such a confusing bill, it defies logical reporting.

$842,000,000 is from individual household income.

$1,060,000,000 is from war profit.

The subtotals equal $1,902,000,000. That's $502,000,000 more than the tax stated tax bill amount.

The following December, the American Economic Society publishes Roy G. Blakey's definitive and detailed analysis of The War Revenue Act of 1917.

Mr. Blakey reports that the bill had, since long under consideration, a target of $1 billion more than the reported amount.

The $2,400,000,000 is funded by adding war tax amounts to the existing tax law.

Mr. Blakey sighs, on page 794 that, “There are enough exceptions... to make it confusing to the initiated, to discover just what is the sum total of all taxes in many specific cases. This condition of affairs and ambiguities inherent in the nature of several matters, particularly in the definition of capital under the war profits title, make it very difficult to give a clear-cut and adequate presentation of the act...”

The 1917 Tax Bill eliminates the war profit tax passed the previous year, 1916.

1916 Tax Act's Munitions Manufacturers Tax levied 12% on the profits of armament manufacturers. This tax was eventually eliminated by the 1917 War Tax Bill.

First, the tax rate on war industry profit is REDUCED to 10%. Then, effective Dec. 31, 1917, eliminated.

Congress decided to impose NO TAX on WAR PROFITS.

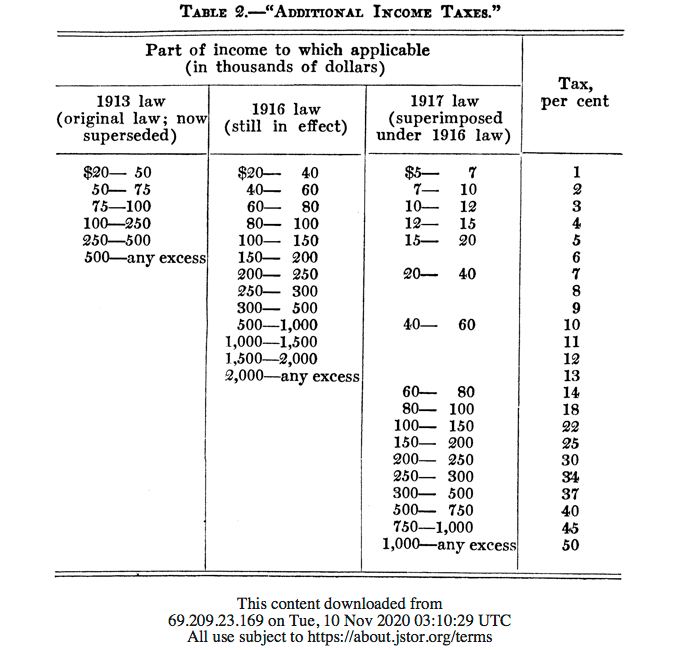

However, The Tax Act of 1916 specifies Additional Tax on Income. Everyone's income. The 1917 War Revenue Act Title XII raises these tax rates.

Households whose income had been except ($5,000 to $20,000) now pay a 1% War Tax.

Households with incomes beginning at $1,000,000 pay a 50%War Tax. Only 139 (twenty-three) USA households are reported as in this tax bracket.

The Additional War has 23 tax brackets. See the below table:

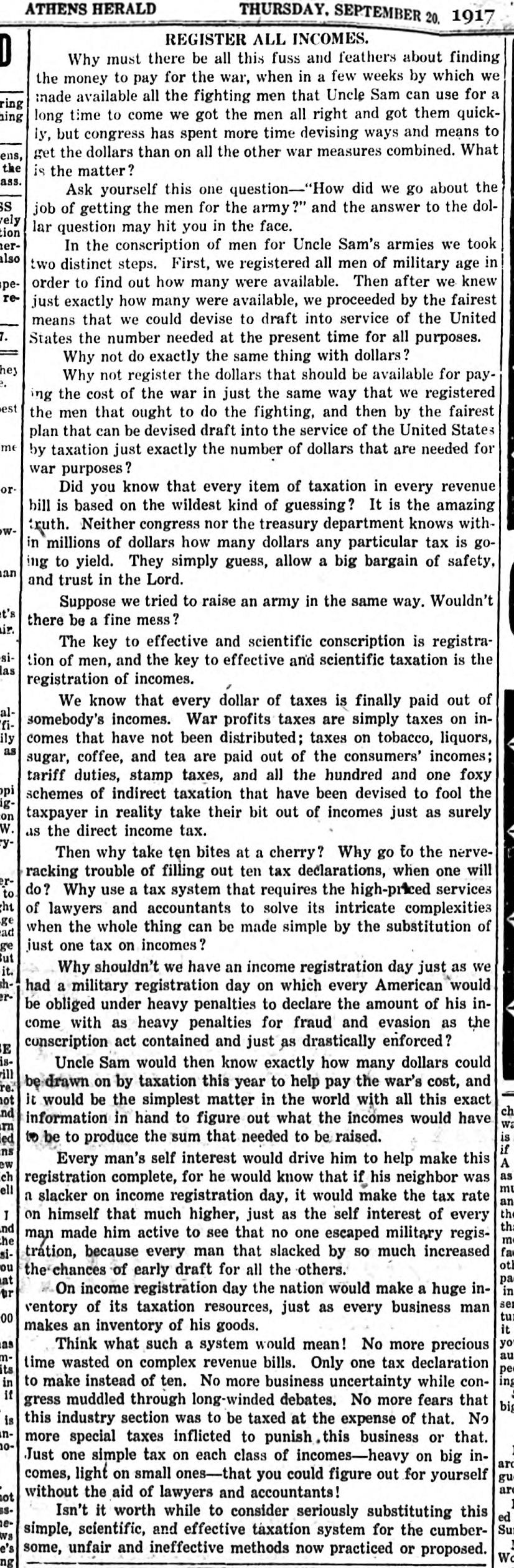

Ten days after the passage of War Tax Revenue Bill of 1917, a newspaper editorialist explains exactly how the war WILL be paid for.